Key Questions Answered in Infinity Business Insights Report on Kitchen Display Systems (KDS) Market In this study, readers can also find detailed data on the qualitative and quantitative growth avenues for the Kitchen Display Systems (KDS) market, which is anticipated to guide market players in making apt decisions in the future. This can help readers comprehend principal factors to foresee growth in the Kitchen Display Systems (KDS) market. This data can help readers solve quantitative growth factors of the Kitchen Display Systems (KDS) market during the forecast period.Ī comprehensive analysis of the business processes of leading market players is also featured in the IBI study on the Kitchen Display Systems (KDS) market. Key indicators of Kitchen Display Systems (KDS) market growth, which contain value chain as well as supply chain studies, and Compound Annual Growth Rate (CAGR), are explained in IBI's study in a complete way.

#Lightspeed pos login pdf

Companies mentioned as follows: QSR Automations, HashMicro, Oracle, Lightspeed POS, Square, Upserve, TouchBistro, Epson, Loyverse, Toast, Rezku, Advantech, Bematech, Sintel Systems, VAR Insights, Brink Kitchenĭownload a Free Sample of Kitchen Display Systems (KDS) Market Report in PDF Format CLICK HERE There does remain one lingering question.Key Players in the market are included based on profile, business performance, etc. Combined, these deals were made with 60.5% stock and 39.5% cash. A consistent feature of all of these deals has been Lightspeed’s heavy reliance on its stock for currency.

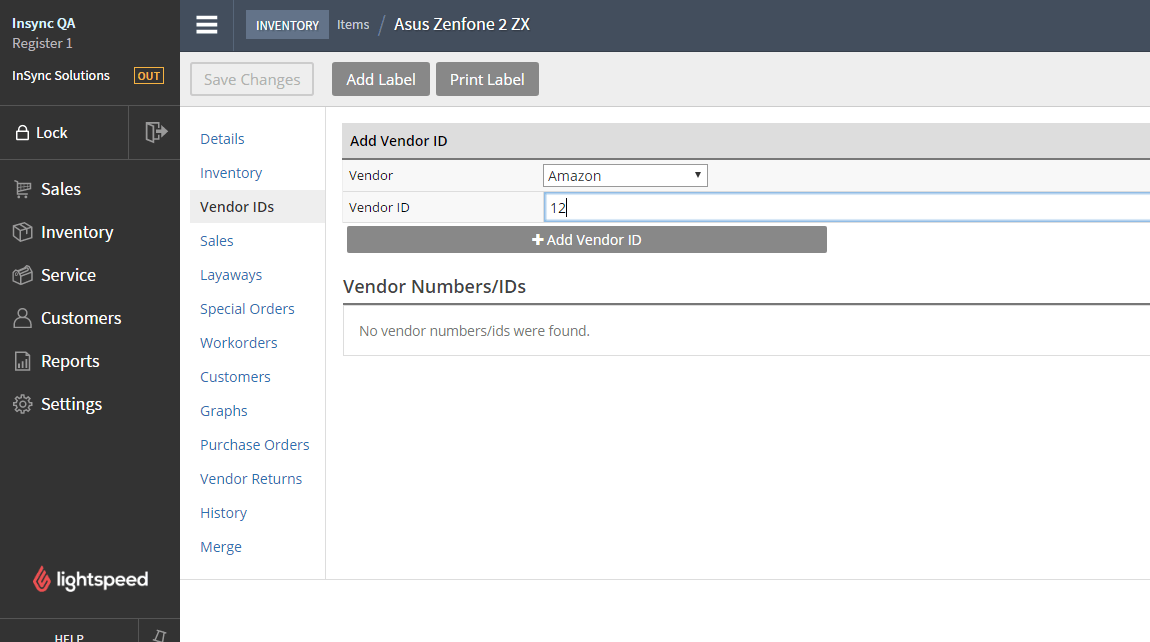

#Lightspeed pos login software

These include restaurant management software player Upserve and rival POS software companies ShopKeep and Vend. Since December 2020 and included the latest transactions, Lightspeed has invested $2.15 billion in acquisitions. Mono-Ecwid Partnership Reflects Growing Demand for SMB eCommerce As economies reopen and business creation accelerates, we hope to embolden entrepreneurs with the tools they need to simplify their operations and scale their ambitions.” “By joining forces with Ecwid and NuORDER, Lightspeed becomes the common thread uniting merchants, suppliers, and consumers, a transformation we believe will enable innovative retailers to adapt to the new world of commerce. So here is what Lightspeed Founder & CEO Dax Dasilva said about the deal. And NuORDER has 3,000 brands using its platform. Ecwid, for example, has 130,000 paying customers on its platform across 100 countries. According to the press release announcing the deal, Lightspeed will have access to thousands of new customers that it can upsell into its existing product suite. These deals seem to be designed to flesh out the service bundle that Lightspeed brings to its customers. Lightspeed Scoops Up Vend, Continuing Its Buying Spree Lightspeed says both deals will close on September 30 this year. Also, NuORDER is more brand-focused than Ecwid. This distinction may have had some bearing on the terms. Meanwhile, Ecwid, is much more of a direct Shopify competitor. NuORDER’s purpose is to connect businesses with suppliers. The company does have a B2B focus that sets it apart from ECWID. The reason why NuORDER got better terms is unclear. NuORDER is getting exactly half of its payout, $212.5 million, in cash. Lightspeed is paying less for NuORDER, $425 million. Lightspeed is paying $500 million for ECWID, with $175 million and the remaining $325 million in subordinate shares of Lightspeed stock. The Ecwid and NuORDER deals break down this way. But consolidation seems like it was inevitable. And voila, the eCommerce space looks very, very crowded.Ĭertainly, the eCommerce business had a real moment during the pandemic.

Then you need to add to the mix website builders with eCommerce capabilities like Wix, Squarespace, Weebly, and many others. Others directly in the space include the likes of Woo Commerce and BigCommerce. The two companies are among the many that compete to varying degrees with Shopify to enable small, midsize, and even larger companies to sell online. The company announced today that it has acquired eCommerce platforms Ecwid and NuORDER for a combined $925 million. The company just dropped nearly a billion to help consolidate the eCommerce space. Canadian point of sale software giant Lightspeed continues to use its robust stock as currency to roll up rivals and bolt on new capabilities.

0 kommentar(er)

0 kommentar(er)